‘Free money from a helicopter’

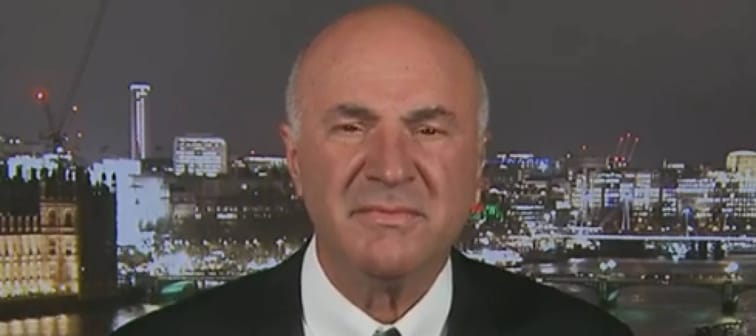

O’Leary also believes that student loan relief will only worsen the inflation the Fed has been struggling to cool.

“There's no way this isn't inflationary,” he stated. “This is free money from a helicopter when we're trying to tame inflation. This just makes it worse.”

The U.S. Federal Reserve has implemented aggressive interest rate hikes to curb inflation. However, the prices of many necessities remain elevated. For example, since the beginning of 2020, the index for food prices has risen by 25%, and the shelter index has increased by 23%, according to data from the Bureau of Labor Statistics.

O’Leary isn’t optimistic that price levels will cool down before the U.S. presidential election this November.

“You can't fix inflation in four months and three weeks,” he said.

He also criticized two of Biden’s notable pieces of legislation, stating, “The Inflation Reduction Act has proven to be inflationary. [The] Chips and Science Act is billions and billions of dollars out of a helicopter for free. That's all inflationary.”

Kiss your credit card debt goodbye

Millions of Americans are struggling to crawl out of debt in the face of record-high interest rates. A personal loan offers lower interest rates and fixed payments, making it a smart choice to consolidate high-interest credit card debt. It helps save money, simplifies payments, and accelerates debt payoff. Credible is a free online service that shows you the best lending options to pay off your credit card debt fast — and save a ton in interest.

Explore better rates‘I really, really, really hate this’

O'Leary argued that the current approach to student loan relief contradicts long-standing values of fiscal responsibility.

“It's so inconsistent with the values we've made people for over 100 years understand,” he said. “We try to teach fiscal responsibility in high school, and what are we telling people now? ‘Don't worry about it, borrow all the money you want for college — it's free, you don't have to pay it back.’”

In other words, he believes that student loan relief promotes the idea that people can borrow freely for college without needing to repay, thereby undermining the teaching of financial responsibility to students.

O’Leary also questioned why those who have already paid back their loans don’t receive similar benefits, expressing strong disapproval of the policy.

“Where's the free money for people that actually paid back their loans? They don't get free money. I hate this. I really, really, really hate this,” he remarked.

The Biden administration has previously addressed accusations of unfairness.

“I don’t see it as unfair. I see it as we’re fixing something that’s broken,” Education Secretary Miguel Cardona stated in April, when testifying about the Education Department’s budget request for next year.

“We have better repayment plans now so we don’t have to be in the business of forgiving loans in the future,” Cardona added.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning. Try Advisor now.